Never Lose Money on your

Individual Retirement Plans

Too Good to Be True?... Nope, It's true here's the

Top# 3 Reason's why your financial advisor has not told you about this little know secret of the 1%

Reason 1: Most financial advisors don’t know that an insurance account like this exists. Nor, do they know how to set it up properly for the account holder.

Reason 2: Most financial advisors recommend financial vehicles that the company they've contracted with tells them to recommend or vehicles they receive the most compensation on.

Reason 3: Straight-up lack of knowledge and as a result, less than 0.07% of Americans have what we call a "Fixed Indexed Annuities (FIA) accounts."

If you have a 401K or a IRA, and are looking to contractually protect from from the market's ups and downs, roll over your qualified plan immediately with out fear of loss!

Your Retirement Contractually Protected!

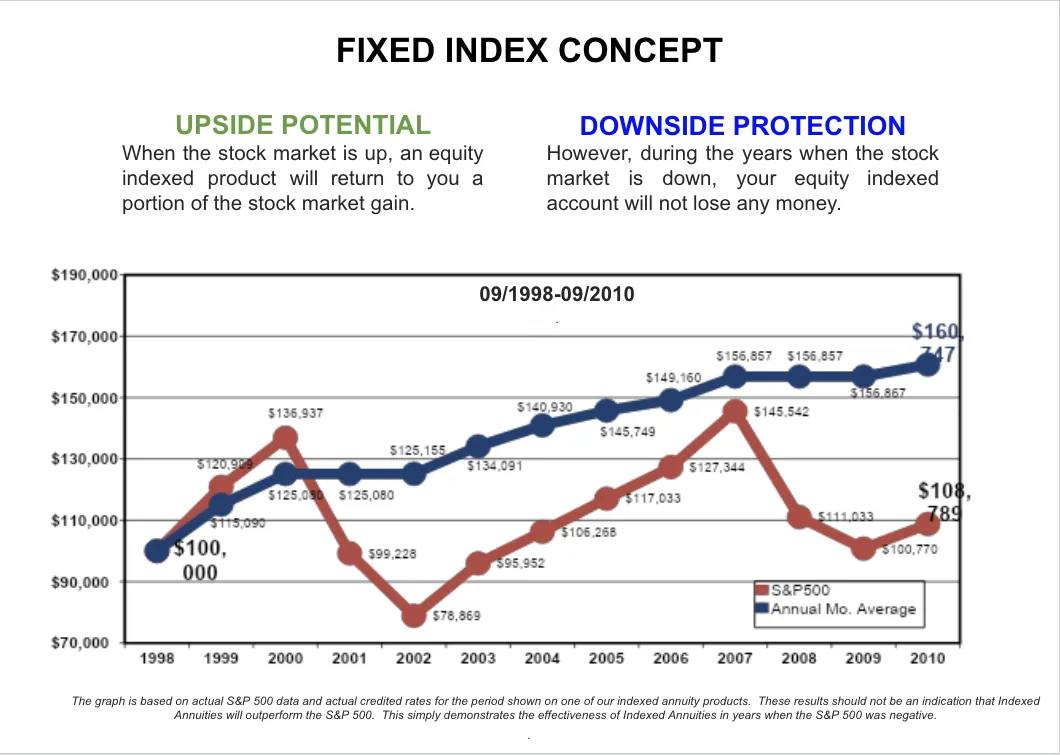

Imagine an account where you get all the upside potential and downside protection while still taking advantage of the upswings in the market. We're all contending with a global pandemic, facing unprecedented social and economic challenges, their has never been a better time for these type of accounts.

In the face of this market volatility, so many clients are asking for our help with what to do with their retirement money.

Did you know that mostly as a result of the pandemic, there is $5 trillion in cash and liquid vehicles waiting to be re-invested?

Below are some snippets of insightful articles that speak to the financial environment we're facing, Also, attached above is a GREAT piece titled Annuities, Retirement, and the Pandemic.

Seismic Shocks into 2021 - 2025

After a 10-year economic expansion, the virus hit the “reset” button on the U.S. economy, wiping out all of the job gains and much of the economic progress in a single fell swoop.

The recovery will take time. Make no mistake about it: We will be paying for this pandemic in various ways for years to come. The cost of COVID-19 includes the enormous amount of government and corporate debt that has been added to support the economy, long-term inflation dynamics, and even pandemic-related effects on income inequality.

The growing government debt burden will likely lead to longer-term upward pressure on inflation and interest rates, while at some point requiring the raising of revenues or cutting of spending, all of which will have the likely impact of curbing economic growth over the next decade. - (Tony Roth, Chief Investment Officer for Wilmington Trust Investment Advisors, Inc.)

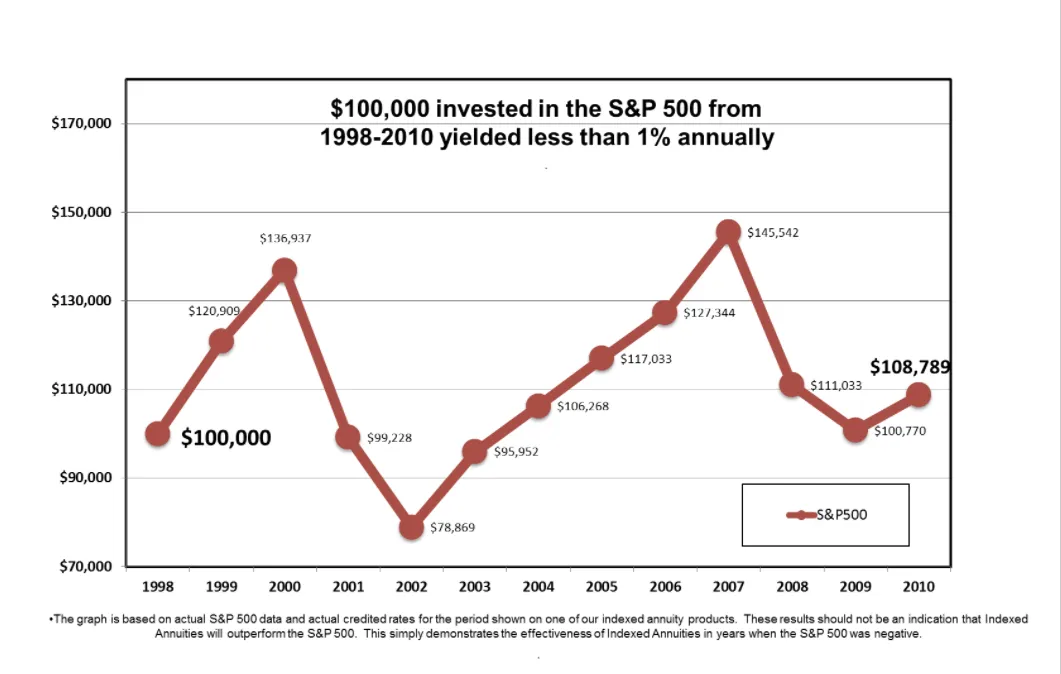

The Lost Decade

Now consider you invested the same $100,000

only now it was protected

Benefits of Fixed Index Retirement Protection

- Guarantees. You can choose the certainty of a fixed rate of interest that is declared each year by the insurance company and subject to minimum guarantees. Your annuity will always have a Minimum Guaranteed Contract Value.

- Growth Potential. You can pursue additional growth with interest credits that are based in part on the performance of an external market index.

- Protection. There is no direct downside market risk to your money.

- Tax Deferral. Annuities provide the advantage of tax-deferred interest accumulation. You don’t pay taxes on any growth until you withdraw money on non-retirement accounts

- Income. At the annuity’s maturity date, you have options to create a regular stream of income — either for a certain period of time or lifetime income

- A Death Benefit. Your annuity can offer your loved ones a quick source of funds to settle matters after your death

- Elimination of Investment-Management Fees on the portion of managed portfolio that's in the fixed

In the News...

There’s nearly $5 trillion on the sidelines right now, which is roughly 25% of the entire economic output of the United States.

The uncertainty and volatility of 2020 caused investors and hedge fund managers to move trillions of dollars into cash or money market funds.

But the consensus is that we’re turning a corner. Businesses and consumers are sitting on record amounts of money — and more is likely to come in additional stimulus from the government

— just anxiously looking to spend it. In other words, we’re sitting on a powder keg. (Matt McCall, Editor, MoneyWire Dec 19, 2020)

Is Your Retirement Protected?

If you have recently changed jobs and have a pending 401K rollover, or an unprotected IRA, wait no more and protect your Retirement Now!

It's your own qualified retirement plan, you can roll it over Now to a contractually protected Fixed Indexed Annuity Account.

A Fixed Indexed Annuity Protection Account is NOT available just for the super-rich…They can be set up by a licensed professional. In order to see if it makes sense for you complete the questionnaire Now.

Find out if you qualify below:

@2023 SelfPensions.com | All right reserved | Privacy Policy